In the aftermath of the COVID-19 pandemic, the supply chain entered into a perfect storm. When March 2020 hit, divisions of the supply chain began slowing and even shutting down, leading to the highest food inflation rates in over 40 years. However, a worldwide pandemic wasn’t the only factor leading to these challenges – other drivers came into play as well.

How does this affect providers? With inflation comes rising costs in food spend. It can be difficult to budget for your senior living communities as the global economy remains in-flux. Tools like DSSI are unique in that they can not only help with understanding how to budget and forecast trends but also in that they come with a team of procurement service experts to help you on your journey toward a proactive end of year.

Drivers of Supply Chain Challenges

As inflation soared over the past two years, it became clear which factors contributed to food inflation: port congestion, rising freight costs, labor, raw materials, inventory/forecasting and inflation itself. Food costs began increasing as ports became congested. Before COVID, most ports only had one ship waiting to be unloaded. The supply chain was extremely effective; laborers and trucks were available to load and unload the cargo and raw materials, and overall, operations were flowing smoothly.

At the end of 2021, 117 ships were sitting out of the port, waiting to be unloaded. There just wasn’t enough transportation or labor available and subsequently, raw materials remained on the ships with nowhere to go.

Simultaneously, once the port congestion began, so too did the rising freight costs. The cost of the shipping containers themselves went up significantly, as did the cost of shipping, freight, and labor. Coupled with a truck driver shortage, manufacturers were forced to focus on only their most profitable products.

Forecasting and Trends in Food

Based on current estimates, food inflation should begin to recover by September. In the meantime, popular items like russet potatoes, French fries, chips, mustard, and cranberries remain difficult to find due to labor challenges and freight costs. Even if providers are purchasing these hard-to-find items, they’re buying at 30-60% more than they did several years ago, because of the additional cost of the raw materials and their availability. Manufacturers are also struggling to determine how to serve both grocery stores and healthcare facilities.

How Inflation Affects Senior Living Providers

In August 2021, DSSI providers were budgeting, as they had done in years past, for 2-3% inflation; now, they’re budgeting for 5% inflation Overall, providers indicated that they’re working on a half percent increase month-over-month just to be on the safe side for their senior communities.

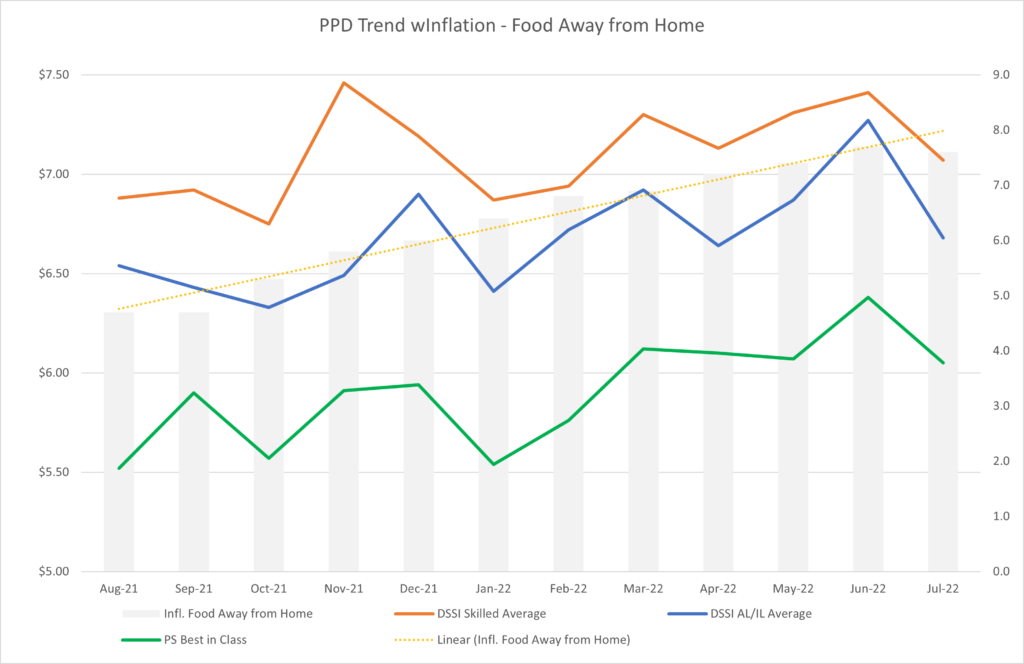

This is what August 2021 – July 2022 looks like for our providers in terms of inflation trends.

At the start of 2021, even as it seemed like we were getting a handle on the pandemic, providers were running a $5 PPD. This is traditionally a bit higher than we’ve seen in the past yet still reasonable. Our average customer hovered around $7 PPD two years ago for high-end assisted living facilities; now, as we progress further towards the end of the year, contracts are expiring, and we’re trying to hold the line. For procurement services customers, $6 PPD is on the horizon as we attempt to combat inflation.

From June 2021 – June 2022, food costs have gone up 7-8%. This is almost a 1% increase month-over-month. As we try to, as we said, “hold the line” for our procurement customers, keep in mind that it’s tough as contract changes go into effect, and the biggest spend categories have been hit by inflation as well. The trend we’ve seen over the past two years has unfortunately been double-digit increases. An extra piece of bacon or sausage patty can add up over time and put providers over-budget, especially as high-spend categories continue to rise.

What Providers Can Expect Moving Forward

As we look towards the new year, it’s important that our providers plan now, even before we hit Q4. Chat with our procurement services team. Ask them how our DSSI tools can help, especially with OGM 3 and centralization. We even have a new method that is an alternate stocking pilot to help pick better substitute products. This not only helps with budgets but also with visibility.

Make sure you’re working with your vendor partners, staying on top of your contracts, and understanding pricing: what price changes are coming into effect? How can you make your own budget changes? Should you make adjustments to your menus? Asking yourself these questions is key to understanding how you can better prepare for Q4 and beyond.

As manufacturers are trying to become more innovative by streamlining menus and making adjustments or being adaptive when products are out-of-stock, systems like DSSI are so important. We can help tighten down the controls on what manufacturers purchase. DSSI can help with budgeting, accurate costs and adjustments, and our procurement services team can advise on AI and even monitor contracts. If you let your contracts go now, you’ll be hurting financially – working with the experts at DSSI can help mitigate costs and food spend challenges. Reach out to a DSSI consultant today to learn more.

Ready to start saving?

Connect with our consultants and find out how much DSSI can start saving you now.